Micro Finance Executive

Entry Level Qualification

10

Career Fields

Banking & Finance

For Specially Abled

About Career

Microfinance is a type of banking service that is for low-income or unemployed individuals or groups. It is provided to people who otherwise don’t have any other means to access these services.

As a microfinance executive, you’ll be responsible for selling micro-loans, micro-pensions, micro-savings, and micro-insurance to those who are financially weak and are not able to access mainstream banking and financial services. Your job role will require you to explain the banking and financial procedures to your clients. This is a challenging role, considering most of your clients will be people who’re financially weak and hence unaware of the basic banking services.

Key roles and responsibilities

As a Micro Finance Executive, your key roles and responsibilities will revolve around spreading awareness about banking and financial services to your clients and helping them in the process of utilizing these services. Some of the key responsibilities include:

1. Understanding the needs of potential customers.

2. Distributing materials, holding camps and making calls to spread awareness.

3. Discussing the financial needs of clients and advising them about products and services which suit their needs.

4. Resolving client queries by co-operating with financial advisors and managers.

5. Assisting customers by guiding them about necessary documentation, helping them in filling out forms along with all other such paperwork and formalities.

6. Performing credit and documentation check and follow up on irregularities.

7. Inputting all information into systems and tracking customer applications through the approval process.

8. Overseeing loan disbursement and perform various administrative and settlement tasks related to services offered such as pensions, insurance etc.

PARTICULARS | DESCRIPTION |

Name | Micro Finance Executive |

Purpose | Support Financially Disadvantaged Communities |

Career Field | Banking & Finance |

Required Entrance Exam | CAT, MAT |

Average Salary | 150000 - 300000 Rs. Per Year |

Companies For You | Grameen Bank, FINCA International, Kiva & Many More |

Who is Eligible | Class 10th Pass |

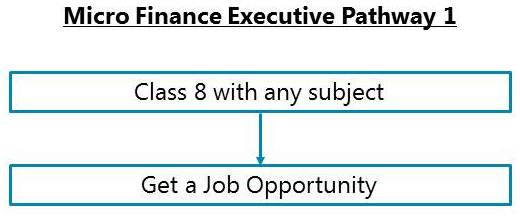

Career Entry Pathway

Class 8th with any subjects

After class 8th (if you’re at least 16 years of age), you can directly interview for a microfinance company. It doesn’t require any qualification and all the required training is provided by the recruiting company itself.

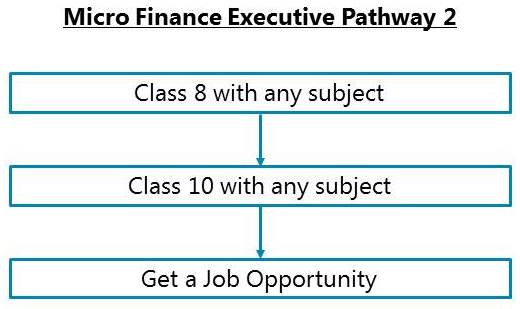

Class 8th with any subjects - Class 10th with any subjects

You can join a microfinance firm even after doing your class 10th, if you couldn’t make it or weren’t eligible for it after class 8th. Here, too, the required training will be provided by the company itself.

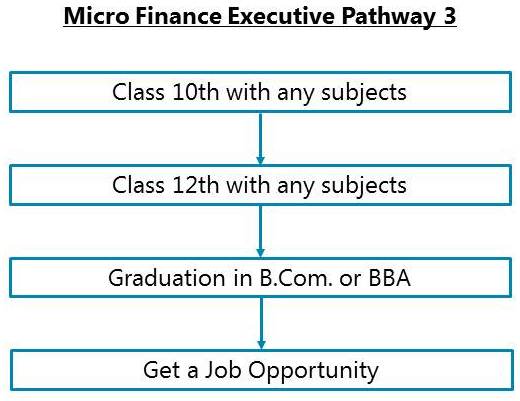

Class 10th with any subjects - Class 12th with any subjects - Graduation in B.Com. or BBA

After completing your high schooling and intermediate, you can opt for a B.Com. or a BBA. Some colleges offer BBA programs with Microfinance as a specialization. This will give you a good first-hand knowledge of how things function in the microfinance industry.

Required Qualification & Competencies

School

1. You can be eligible to apply to become a Micro Finance Executive soon as you pass Class 8.

2. It is however highly advisable that you at least complete Class 10 qualification if possible, and preferably also your Class 11 and 12 for better prospects.

Undergraduate

A Bachelor’s degree in Commerce or Business Administration is a very flexible option which can help you to transition to alternative career tracks in banking and finance should you choose to pursue them at a later point.

Competencies Required

Interests

Enterprising: You should have interests for Enterprising Occupations. Enterprising occupations involve taking initiatives, initiating actions, and planning to achieve goals, often business goals. These involve gathering resources and leading people to get things done. These require decision making, risk taking and action orientation.

Conventional: You should have interests for Conventional Occupations. Conventional occupations involve repetitive and routine tasks as well as fixed processes or procedures for getting things done. These occupations involve working more with data, systems, and procedures and less with ideas or creativity.

Abilities

Abstract Reasoning: The ability to understand ideas which are not expressed in words or numbers; the ability to understand concepts which are not clearly expressed verbally or otherwise.

Deductive Reasoning: The ability to apply general rules and common logic to specific problems to produce answers that are logical and make sense. For example, understanding the reasons behind an event or a situation using general rules and common logic.

Information Ordering: The ability to arrange things or actions in a certain order or pattern according to a specific rule or set of rules (e.g., patterns of numbers, letters, words, pictures, mathematical operations).

Inter-Personal: The ability to build and maintain good relationships with others at workplaces and elsewhere.

Numerical Reasoning: The ability to add, subtract, multiply, divide, and perform other basic numerical calculations correctly.

Oral Comprehension: The ability to listen to and understand information and ideas

Verbal Reasoning: The ability to think and reason with words; the ability to reason out ideas expressed in words.

Written Comprehension: The ability to read and understand information and ideas presented in writing.

Written Expression: The ability to communicate information and ideas in writing so others will understand.

Knowledge

Accounting: Knowledge of various principles and methods for maintaining records of commercial and financial transactions and records, preparing various reports and statements, ensuring compliance with commercial and business laws and rules of a country, etc.

Economics: Knowledge of economic principles and practices; understanding how various resources such as land, labour and capital are used; how market demands rise and fall; how a country collects and spends money; and similar other economic issues and situations.

Skills

Active Learning: Focused and continuous learning from various sources of information, observation and otherwise for application in getting work done.

Coordination: Skills in working together with other people to get things done.

Judgment and Decision Making: Skills in considering pros and cons of various decision alternatives; considering costs and benefits; taking appropriate and suitable decisions.

Managing Financial Resources: Skills in determining how money should be spent to get the work done, and accounting for these expenditures.

Negotiation: Skills in bringing others together and trying to reconcile differences.

Persuasion: Skills in persuading others to change their minds or behaviour.

Problem Solving: Skills in analysis and understanding of problems, evaluating various options to solve the problems and using the best option to solve the problems.

Service Orientation: Skills in or keen interest to help and assist people.

Time Management: Skills in prioritizing work, managing time effectively.

Personality

1. You are always or mostly organised in your day-to-day life and activities.

2. You are always or mostly careful about your actions and behaviour.

3. You are always or mostly disciplined in your action and behaviour.

4. You are always calm or generally remain calm in most situations.

5. You always feel secure in your surroundings and in most situations.

6. You trust others sometimes but not always.

Career - Job Opportunities & Profiles

Following are some of the job opportunities available:

1. Micro Finance Executive

2. Loan Disbursement Official

3. Collection Official/Representative

4. Relationship Officer

Work environment

Your work will take you outdoors a lot. It will involve a lot of traveling and searching for potential clients. You will have to work in competitive environments. Often your income may be commission based. The work environment will be challenging in terms of the daily tasks that you’ll need to accomplish - including assisting and serving people from the financially excluded strata and enlightening them about the services offered.

Career Growth

Because this is a vocational job, the growth of your career will depend on your experience and skills. From an entry-level job, you can grow to be a branch manager. As a branch manager, your roles will be highly diverse, from managing a team to dealing directly with the clients. After an experience of 8-10 years, you can apply for the position of a regional business manager and you’ll be looking at things in a much broader sense. The pay here will be upper of Rs. 50,000 per month.

Salary Offered

1. In an entry-level job at you earn Rs. 10,000 per month, and up to Rs. 20,000 per month.

2. In junior levels jobs, you can expect to be paid Rs. 25,000 per month and up to Rs. 35,000 per month as an established junior executive customer relation services.

3. As a mid-level employee, you can earn Rs. 35,000 per month and up to Rs. 50,000 per month working as a senior executive, or an area-in-charge.

Monthly Earnings In Indian Rupee

1. Entry level: 0 - 2 years of work experience

2. Junior Level: From 1 to 12 years of work experience

3. Mid-Level: From 5 to 20+ years of work experience

4. Senior Level: From 10 to 25+ years of work experience (there could be exceptions in some high-end technical, financial, engineering, creative, management, sports, and other careers; also in the near future, people will reach these levels much faster in many careers and in some careers, these levels will have no meaning as those careers will be completely tech skill driven such as even now, there is almost no level in a Cyber Security Expert’s job)

Work Activities

1. Addressing grievances and resolving conflicts: Handling complaints and grievance to resolve; resolving conflicts among co-workers or others at workplace or outside in relation to your work.

2. Analysing and interpreting data and information: Analysis of data and information to find facts, trends, reasons behind situations, etc.; interpretation of data to aid in decision making.

3. Calculating and computing: Calculating or computing using various mathematical formula and functions using computers or otherwise; doing financial or commercial calculations or computations.

4. Communicating with co-workers and others: Communicating with people in writing, verbally or otherwise inside your workplace and various other people who have professional relationships with your place of work including vendors, government officials, etc. or with people at large.

5. Decision making and problem solving: Analysis of data and information; evaluation of alternative decisions and results of decisions; taking the right decisions and solving problems.

6. Developing and maintaining inter-personal relationships: Developing professional relationships with co-workers and others outside organisations and maintaining good relationships.

7. Using computers for work: Using computers for day-to-day office work; using computer software for various applications in day-to-day professional work; entering data and process information; for writing.

8. Working in a team: Working in a team of people; developing team; maintaining professional relationships among team members.

Future Prospects

The future of in the domain of Microfinance seems extremely bright. There are already active policy-led efforts being put to expand the economic net of the country to backward parts of the country - to the population that is mostly left outside of the baking spectrum. This is being done in the need to cater to their financial requirements and help them with any financial instrument they require. Seeing all this, there’s no denying that the requirement for a microfinance executive is bound to increase in the years to come.

Future prospects At A Glance