Investment Advisor (Stock Markets / Equity Dealer)

Entry Level Qualification

12

Career Fields

Banking & Finance

For Specially Abled

Career Entrance Exam

About Career

As an Investment Advisor (Stock Markets/Equity Dealer), you will advise various clients over phone and through other online modes about in which stock or equity share they should invest for maximum gain and growing their wealth. You will advise them about which equity shares to sell, which to hold and which to buy A company's capital is generally divided into shares which have identical value. For example, a company may have a share capital of Rs. 1,00,000 which can be divided into 10,000 equity shares of Rs. 10 each.

These shares are called equity shares which are traded at stock exchanges in order to make profits or gains.

The prices of equity shares rise or fall due to higher or lower demand for the shares. For example, you may buy shares of a company at a value of Rs. 10 but may sell off the shares when the price rises to Rs. 14. So you profit or gain Rs. 4 for each share. All the trading activities are done online by brokers or dealers.

As an Investment Advisor, your job will be to buy and sell equity shares as well as other financial products linked with equity shares with an objective to ensure maximum gain over the purchase price. You will trade or deal on behalf of the company you are working for or if you are working for a financial services company, you will trade or deal on behalf of the customers of the company.

Key roles and responsibilities

As a Broker your key responsibilities will include:

1. You will sell various securities and investment options to clients.

2. You will advise clients on appropriate investment options for their financial situations.

3. You will execute trades and sells at the stock market for individual clients or on behalf of a financial institution.

4. You will need to identify investment strategies to persuade clients through analysis, monitoring, and research of how stocks and funds perform and keep tabs on all sorts of events that might influence the direction of financial markets.

PARTICULARS | DESCRIPTION |

Name | Investment Advisor (Stock Markets / Equity Dealer) |

Purpose | Provide Expert Advice |

Career Field | Banking & Finance |

Required Entrance Exam | CAT, TANCET MBA, CUET UG, CUET PG |

Average Salary | 150000 - 300000 Rs. Per Year |

Companies For You | Charles Schwab, Fidelity Investments & Many More |

Who is Eligible | Class 12th Pass |

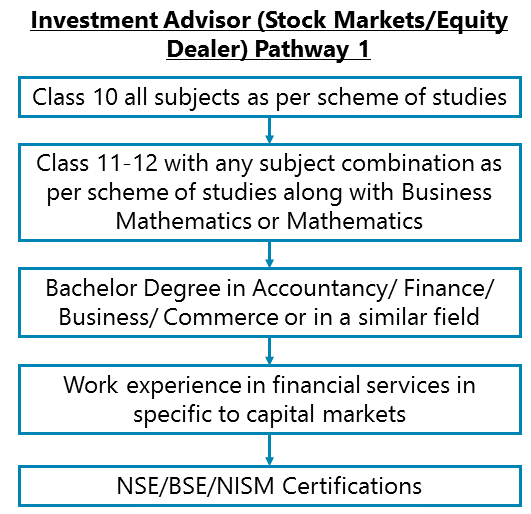

Career Entry Pathway

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies along with Business Mathematics or Mathematics - Bachelor Degree in Accountancy/Finance/Business/Commerce or in a similar field - Work experience in financial services in specific to capital markets - NSE/BSE/NISM Certifications.

After completing Class 11-12 with any subject combination as per scheme of studies along with Business Mathematics or Mathematics, you can opt for a Bachelor Degree in Accountancy, Business, Finance, Commerce, or a similar field. After this, you can get a job in financial services that cater specifically to capital markets. Once you have some work experience, you can opt for NSE/BSE/NISM certifications to increase your market worth and find more job avenues.

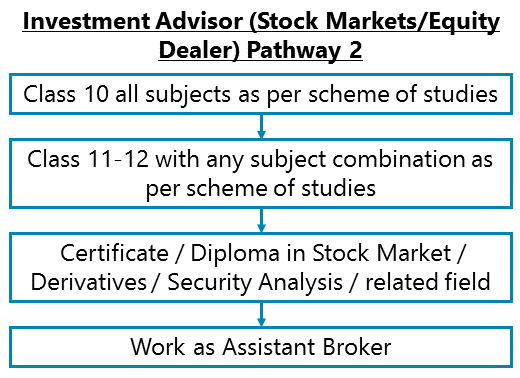

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies – Certificate / Diploma in Stock Market / Derivatives / Security Analysis / related field – Work as Assistant Broker

After your Class 11-12 with any subject combination as per scheme of studies, you can opt for a Certificate or Diploma course in the Stock Market / Derivates/ Security Analysis/ similar field. Now you are eligible to work as an assistant broker with a brokerage firm.

Required Qualification & Competencies

School

After completing your secondary level studies (Class 10 all subjects as per scheme of studies), you should complete your higher secondary level studies with any subject combination as per scheme of studies having Business Mathematics preferably.

Undergraduate

You can either complete your graduation with a Bachelor’s degree in any subject or you can choose to get a B.Com degree in Accountancy/Finance/Business.

Competencies Required

Occupational Interests

Enterprising - You should have interests for Enterprising Occupations. Enterprising occupations involve taking initiatives, initiating actions, and planning to achieve goals, often business goals. These involve gathering resources and leading people to get things done. These require decision making, risk-taking, and action orientation.

Conventional - You should have interests for Conventional Occupations. Conventional occupations involve repetitive and routine tasks as well as fixed processes or procedures for getting things done. These occupations involve working more with data, systems, and procedures and less with ideas or creativity.

Personality traits

1. You are always or mostly organised in your day-to-day life and activities.

2. You are always or mostly careful about your actions and behaviour.

3. You are always or mostly disciplined in your action and behaviour.

4. You trust others sometimes but not always.

5. You are always practical or in most situations.

6. You always or mostly prefer to stick within a routine or carry out routine and repetitive activities.

Skills:

1. Active Listening - paying complete attention to what other people are saying and understanding their point of view.

2. Critical Thinking - use logic and reasoning abilities to identify and solve problems.

3. Speaking - able to communicate well with co-workers as well as outsiders.

4. Negotiation - Skills in bringing others together and trying to reconcile differences.

5. Judgment and Decision Making - Skills in considering the pros and cons of various decision alternatives; considering costs and benefits; taking appropriate and suitable decisions.

6. Persuasion - Skills in persuading others to change their minds or behavior.

7. Problem Solving - Skills in analysis and understanding of problems, evaluating various options to solve the problems and using the best option to solve the problems.

8. Service Orientation - Skills in or a keen interest to help and assist people.

Knowledge:

1. English Language - Knowledge about English grammar, words, spelling, sentence construction, using English to communicate with others, reading in English, etc.

2. Customer Service - Knowledge about how to provide customer services. This includes understanding customer needs, helping customers to use products and services, answering customer queries, handling customer complaints and grievances, and evaluating customer satisfaction.

3. Sales and Promotion - Knowledge of the various principles, theories, methods, systems and processes to communicate and promote the benefits of various products or services of an organization to a targeted group of customers, influencing their buying decisions and convincing them to buy the products or services.

Career - Job Opportunities & Profiles

Following are some of the job opportunities available in Investment Advisor (Stock Markets/Equity Dealer):

1. Investment Adviser (Equity)

2. Customer Service Associate/Executive (Equity)

3. Equity Dealer

Sometimes Stock Brokers are also referred to as Customer Service Associates/Relationship Managers.

Work environment

You will have to typically work long hours in a highly stressful environment where circumstances of the financial markets change in the blink of an eye. You may have to handle multiple computer terminals simultaneously. Also, your job will require you to handle multiple customer calls and respond to their queries/messages/emails.

Career Growth

Working in an equity trading company, you will essentially begin your career as as an Investment Advisor and then as you gain more experience (around 5-10) years, you can upgrade to mid-level job roles such as Assistant Manager, Branch Manager, Equity Operation Manager, etc.

Salary Offered

1. As an Investment Advisor (Stock Market), you will earn about Rs. 12,000 – 18,000 per month plus incentives from your work performance.

2. With experience, you may look forward to earn about Rs. 15,000 -25,000 per month plus incentives (after having 4-6 years of experience).

3. Mid-level salaries could range from Rs. 25,000 – 50,000 per month or even more + incentives.

4. Senior level salaries could range from Rs. 35,000 – 70,000 per month or even more + you may earn lucrative incentives.

Monthly Earnings In Indian Rupee

1. Entry level: 0 - 2 years of work experience

2. Junior Level: From 1 to 12 years of work experience

3. Mid-Level: From 5 to 20+ years of work experience

4. Senior Level: From 10 to 25+ years of work experience (there could be exceptions in some high-end technical, financial, engineering, creative, management, sports, and other careers; also in the near future, people will reach these levels much faster in many careers and in some careers, these levels will have no meaning as those careers will be completely tech skill driven such as even now, there is almost no level in a Cyber Security Expert’s job)

Work Activities

1. Keeping abreast with the latest information about industries, businesses and equity share prices across various stock exchanges in India and abroad.

2. Keeping abreast with the latest developments in the economic and financial situations in the country and in the world.

3. Offering suggestions and advice to companies or individual clients about how to maximize gain in stock market investments.

4. Offering suggestions and advice to companies or individual clients about which shares to buy, which to hold and which to sell in order to maximize gains from investment in the stock markets.

5. Carry out trading (that is, buying and selling) online at various stock exchanges on behalf of companies or individual customers.

6. Research and analyze equity share prices, stock market situations, business, and industries in order to determine which equity shares to buy, which to hold and which to sell.

7. Use of various financial software for data analysis, equity trading, etc.

Future Prospects

Lately, the stock market in India has been in great shape. In fact, in the last two years, the Nifty 50 index comprising of the top 50 companies on the India stock market exchange rose from 7000 points to over 10000 points. Also, according to the latest IBEF (India Brand Equity Foundation) stats, the Mutual Fund (MF) industry in India has witnessed a rapid growth in Assets Under Management (AUM) with the total AUM of the industry reaching US$ 342.01 billion between April-November 2018. With rising incomes and India’s rapidly growing banking and insurance sector, the demand for quality financial services has also increased significantly. Thus, employment opportunities in the Indian BFSI and Equity trading sector are going to increase in the near future.

Future Prospects At A Glance