Insurance Agent

Entry Level Qualification

10

Career Fields

Banking & Finance

For Specially Abled

Career Entrance Exam

About Career

PARTICULARS | DESCRIPTION |

Name | Insurance Agent |

Purpose | Policy Sales |

Career Field | Banking & Finance |

Required Entrance Exam | LIC AAO & AE, OICL AO |

Average Salary | 150000 - 200000 Rs. Per Year |

Companies For You | State Farm, Allstate, Farmers Insurance & Many More |

Who is Eligible | Class 10th Pass |

As an Insurance Agent, you will be advising people who want to buy insurance policies, help them to apply for the policies and receive the policies after payment of insurance premiums. You will be advising people about the various features and benefits of different insurance policies such as life insurance, health insurance, and general insurance (general insurance includes fire insurance, vehicle insurance, property insurance, machinery insurance, consumer good insurance, crop insurance, etc). Your job will be to build awareness about the necessity of various types of insurance policies and educate people about the benefits of various policies. You will meet customers who want to buy insurance policies and advise them about the right policies that they should buy accordingly to their needs or for their future financial requirements.

Key Roles and Responsibilities:

As an Insurance Agent, you will be engaged with one or more of the following roles and responsibilities: -

1. You will advise and educate people who want to buy insurance policies about the features and benefits of different insurance policies include life insurance, health insurance, and general insurance.

2. You will assess and understand the needs of the customers or understand their future financial requirements.

3. You will assist customers to decide which insurance policy to buy according to their needs or future financial requirements.

4. You will help existing insurance policyholders to pay their premiums in time or renew their policies (premium means the amount an insurance policyholder has to pay to the insurance company to receive an insurance policy). You will also advise and educate them about any additional policies that they may wish to buy.

5. You will maintain data about the potential and existing insurance policyholders. You will keep track of the premium payment schedules of your customers as well as keep track of the renewals.

6. You will help insurance policyholders or their nominees to claim the benefits of the various insurance policies when the need arises or when the policies mature (maturing means the period over which an insurance policy remains valid gets over).

7. You will ensure that all policy requirements are satisfied as per the insurance company’s policies as well as all the rules and regulations governing insurance policies in the country.

8. You will learn about new insurance policies, features and benefits and keep yourself updated with knowledge about various financial services in order to perform well in your jobs.

Career Entry Pathway

Class 10 all subjects as per scheme of studies – obtain training at an ITI as an Insurance Agent for 6 months– appear for IRDAI exam through an insurance company – get insurance agent license

After completing Class 10 all subjects as per scheme of studies, you may obtain training at an Industrial Training Institute (ITI) as an Insurance Agent for 6 months. However, this pathway is available for you only if are from a village, population of which is less than 5000. Then you must apply to an insurance company and sit for IRDA IC 38 Exam conducted by Insurance Regulatory and Development Authority of India (IRDAI). You can only write the exam through an insurance company and not individually. After the exam, you will be trained for 50-75 hours before the grant of your license. The license stays valid for three years after which you need to renew it. Your employing company should guide you through these processes.

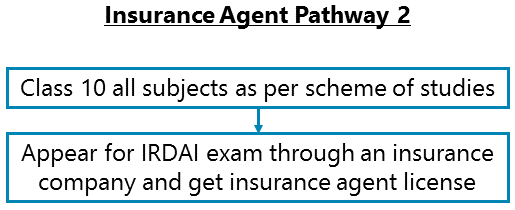

Class 10 all subjects as per scheme of studies – appear for IRDAI exam through an insurance company – get insurance agent license

This pathway is available for you only if are from a village, population of which is less than 5000.After completing Class 10 all subjects as per scheme of studies, you must apply to an insurance company and sit for IRDA IC 38 Exam conducted by Insurance Regulatory and Development Authority of India (IRDAI). You can only write the exam through an insurance company and not individually. After the exam, you will be trained for 50-75 hours before the grant of your license. The license stays valid for three years after which you need to renew it. Your employing company should guide you through these processes.

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies - appear for IRDAI exam through an insurance company – get insurance agent license

After completing Class 11-12 with any subject combination as per scheme of studies, you must apply to an insurance company and sit for IRDA IC 38 Exam conducted by Insurance Regulatory and Development Authority of India (IRDAI). You can only write the exam through an insurance company and not individually. After the exam, you will be trained for 50-75 hours before the grant of your license. The license stays valid for three years after which you need to renew it. Your employing company should guide you through these processes.

Required Qualification & Competencies

It is compulsory to obtain an IRDA license through an insurance company of your choice to practice as an Insurance Agent in India. If you belong to rural areas with a population less than 5000, you should complete Class 10 in school to obtain an Insurance Agent License. However, for other areas, the minimum qualification required is to pass Class 11-12.

Competencies Required

1. You should have interests for Enterprising Occupations. Enterprising occupations involve taking initiatives, initiating actions, and planning to achieve goals, often business goals. These involve gathering resources and leading people to get things done. These require decision making, risk-taking, and action orientation.

2. You should have interests for Conventional Occupations. Conventional occupations involve repetitive and routine tasks as well as fixed processes or procedures for getting things done. These occupations involve working more with data, systems, and procedures and less with ideas or creativity.

3. You should have interests for Social Occupations. Social occupations involve helping or assisting others; these involve working with and communicating with people to provide various services; these may involve educating and advising others.

4. Personal Care Service - Knowledge of how to provide various assistance and services to others. This includes looking after the needs of individuals, understanding what they need and provide all assistance at home or elsewhere.

5. Active Listening Skills - Giving full attention to what other people are saying, understanding the points being made by others, asking questions, etc.

6. Service orientation - Skills in or a keen interest to help and assist people.

7. Critical Thinking Skills - Skills in the analysis of complex situations, using logic and reasoning to understand the situations and take appropriate actions or make interpretations and inferences.

8. Inter-personal Ability - The ability to build and maintain good relationships with others at workplaces and elsewhere.

9. You always or mostly prefer to stick within a routine or carry out routine and repetitive activities.

10. You are always or most helpful to others.

11. You are always calm or generally remain calm in most situations.

12. You are always or mostly caring, supportive, sympathetic and kind to others.

Career - Job Opportunities & Profiles

1. In the beginning of your career, you can get a job as an Insurance Advisor with life insurance or general insurance companies. Many such opportunities are available. Some of the insurance companies where you can get a job are Life Insurance Corporation of India, ICICI Prudential Life Insurance, SBI Life Insurance, HDFC Standard Life Insurance, Tata AIA Life Insurance, The New India Assurance Company Limited, Oriental Insurance Company Limited, etc.

2. You may also get opportunities in Banks which offers various insurance policies, generally known as Bancassurance (they offer insurance policies of insurance companies). Even insurance companies recruit people for placing in banks to help banks’ customers buy insurance products.

3. In banks, you can get jobs as a Bancassurance Executive, Customer Service Executive or in a similar position. Some of the companies where you can get a job are PNB Metlife India Insurance, IDBI Federal Life Insurance Company, etc.

4. You may also get a job with small to medium scale agencies which are contracted by insurance companies or banks to offer insurance policies to customers. In these agencies, you may get a job as an Insurance Sales Officer/Tele-sales Officer.

Career Growth

1. With experience, you can get promotions to various senior level roles progressively. From being an Insurance Advisor, you can become a Unit Manager, Relationship Manager, Sales Manager or Agency Sales Manager.

2. However, for getting promoted to higher level jobs, you will need further educational qualifications such as graduation, post-graduation, etc. apart from training in different types of insurance policies.

3. After having 5-8 years of experience, you can become an Area Sales Manager, Divisional Sales Manager, Senior Relationship Manager, etc.

4. After having 8-10 years of experience, you can become a Branch Head, Regional Sales Manager, etc.

5. At the senior level, with 12-15 years or more experience, you can become National Head of sales in insurance companies.

Salary Offered

1. In the entry level, you may earn about Rs. 10,000-15,000 per month as salary. You will also earn commissions on the amount of premium collected.

2. With 1-3 years of experience, you may earn about Rs. 15,000-25,000 a month.

3. With 4-10 years of experience, you may earn about Rs. 20,000 – 45,000 or more per month.

4. Senior professionals may earn anywhere between Rs. 80,000 – 1,50,000 per month or even more in salaries and commissions.

Monthly Earnings In Indian Rupee

1. Entry level: 0 - 2 years of work experience

2. Junior Level: From 1 to 12 years of work experience

3. Mid-Level: From 5 to 20+ years of work experience

4. Senior Level: From 10 to 25+ years of work experience (there could be exceptions in some high-end technical, financial, engineering, creative, management, sports, and other careers; also in the near future, people will reach these levels much faster in many careers and in some careers, these levels will have no meaning as those careers will be completely tech skill driven such as even now, there is almost no level in a Cyber Security Expert’s job)

Work Activities

As an Insurance Agent, you will be:

1. Developing and maintaining inter-personal relationships – Developing professional relationships with co-workers and others outside organisations and maintaining good relationships.

2. Communicating with customers – Communicating with potential and existing customers of your organisation in writing, verbally or otherwise.

3. Communicating with co-workers and others – Communicating with people in writing, verbally or otherwise inside your workplace and various other people who have professional relationships with your place of work including vendors, government officials, etc. or with people at large.

4. Getting Information and learning – Observing, hearing, reading, using computers, or otherwise obtaining information and learning from it.

5. Using computers for work – Using computers for day-to-day office work; using computer software for various applications in day-to-day professional work; entering data and process information; for writing.

6. Analyzing and interpreting data and information – Analyzing data and information to find facts, trends, reasons behind situations, etc.; interpreting data to aid in decision making.

7. Making decisions and solving problems – Analyzing data and information; evaluating alternative decisions and results of decisions; taking the right decisions and solving problems.

Future Prospects

1. The future of Insurance Agents looks extremely bright and promising as this industry is expected to show growth to almost USD 280 billion by 2020, with new distribution channels and innovative products being introduced. It can be predicted to grow by 12-15 per cent annually for the next three to five years.

2. The Government of India is introducing various insurance schemes such as Pradhan Mantri Suraksha Bima Yojana (PMSBY), Rashtriya Swasthya Bima Yojana (RSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) etc. for rural India. More trained and certified Insurance Agents are needed to manage these insurance schemes.

Future Prospects At A Glance